The place where

Big Ideas Really Do Take Off

There’s a whole side of Orlando most people don’t know. The region has the fastest growing job market and population in the country, outpacing other fast-growing metros like Dallas, Atlanta and Austin and propelling innovation forward. From its roots as a university town built to win the space race, Orlando is on the cutting edge of new technology innovations – advancements that will create a brilliant future for not only the region and its residents, but the entire world.

-

Named a “Rising Star” City for Tech Employment and Job Growth

Brookings Institute, 2022

-

500K+ Higher-Education Students Within 100 Miles of Orlando

IPEDS, National Center for Education Statistics, 2022

-

No. 3 Best City to Launch A Startup

Clever, 2022

-

80%+ of Workers Are Employed Outside of Leisure & Hospitality

U.S. Bureau of Labor Statistics, 2023

Get funded

Available Financing

Companies at every stage have numerous resources available to finance their business, from government funding to regional matching grants to bonds. Both Florida and Orlando are also home to venture capitalists, angel investors as well as commercial banks.

Private Capital

Orlando is home to many sources of private capital including venture capital, angel investors, start-up financing and small business investment companies.

Government Funding

Federal, state and local grant programs that provide funding for small businesses and start-ups.

Matching Grants

Grants support industry-university research projects and SBIR/STTR awards in which one of the three participating universities is a partner.

Bonds

Learn more about if you qualify for bonds in Orange and Seminole counties in the Orlando region.

“My experience starting my company in Orlando has been incredible. The community truly wants to see you grow and succeed and having that kind of support from my peers has been invaluable…”

– Suneera Madhani

CEO & Co-Founder, Fattmerchant

From start-up to Scale up

Business Growth Programs

Orlando’s community is enthusiastic about partnership and collaboration, and there are many resources that entrepreneurs can take advantage of to grow and scale their businesses in the region.

Florida Virtual Entreprenuer Center

The Florida Virtual Entrepreneur Center is an online directory of resource agencies that serve entreprenuers, organized for each stage of your business.

GrowFL

GrowFL is on a mission to provide strategies, resources and support to second-stage companies for next level growth.

National Entreprenuer Center

Through a cooperative effort of a diverse group of organizations, the National Entreprenuer Center offers access to professional business assistance, quality educational programming and practical industry expertise.

Orlando Tech Council

The Orlando Tech Council works to develop new programs with the core objectives: strengthen the Orlando region’s innovation resources, create new opportunities for companies to scale and to amplify the region’s success stories, raising Orlando’s global profile in entrepreneurship and innovation.

Small Business Development Center at UCF

The Small Business Development Center at UCF provides business seminars and no-cost one-on-one business consulting for small business owners.

UCF Business Incubation Program

The UCF Business Incubation Program helps startup companies develop into financially stable, high impact businesses.

StarterStudio

StarterStudio is a robust entrepreneurial community for tech-enabled startups and other innovators that are adding fuel to Florida’s growing technology economy.

Orlando SCORE

A nonprofit association supported by the U.S. Small Business Administration that offers free advice from local experts to help start or grow your small business

Economic Development and Research

Our Services and Additional Resources

Resource Center

The Partnership uses cutting edge economic and industry research to understand the Central Florida market.

Economic Development Services

The Partnership offers a full range of services to businesses looking to locate or expand in the Orlando area with a staff of business development experts who can assist in everything from site location analysis to evaluation of financial assistance.

International Resources

The Partnership works directly with international companies looking to expand into the United States and offers global business assistance, market intelligence and site selection services.

Space / to / Create & Innovate

Get the Orlando CoWorking Guide

Orlando’s ever-growing class of creative technologists are bringing the region global recognition as a place to build, a place to play, a vibrant, inclusive community to call home, and an inspiring place to work. This diversity is represented by an explosion of growth in the local startup community, with a range of skillful experts finding new ways to use technology.

News About Orlando’s Startup Community

Venture Capitalists Connect Orlando Startups with Seed Funds

Orlando Biotechnology Company Lights the Way for the Next Generation of Drug Discovery

The Growth of Social Entrepreneurship in Orlando

much more than a one company town

Key Technology Sectors

80 percent of workers in Orlando are employed outside of the leisure and hospitality industry. We’re a little more high-tech than you might think.

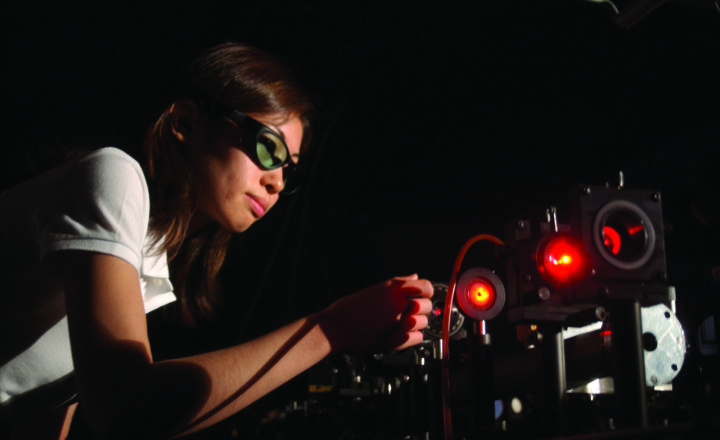

Optics & Photonics

Leading the nation in tourism and photonics technology.

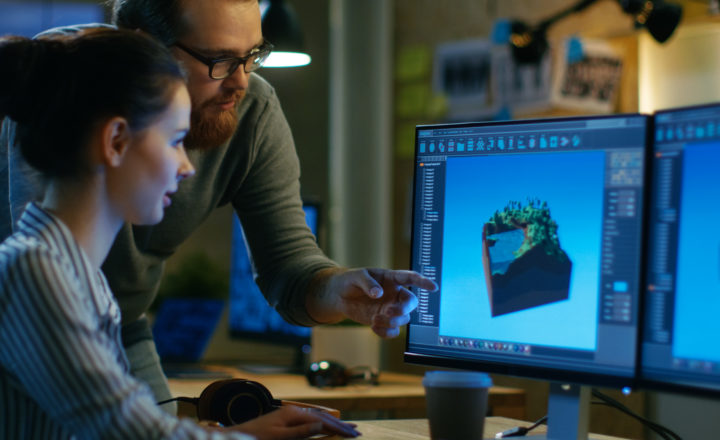

Simulation

The birthplace of the experience economy.

Digital Media

The most visited destination is also a hub for creativity.